If you’ve just started running ads on Facebook (Meta) and are noticing multiple small charges on your credit card, you’ve probably got several alarm bells going off. We get it—seeing a string of transactions labeled “Facebook” with random codes screams fraud and will set off all the alarm bells. But before you panic, let’s break down what’s really happening with Facebook’s billing practices.

Why Am I Seeing So Many Facebook Charges?

If you’re new to Facebook Ads, the company’s billing practices will most certainly catch you off guard. You’re going to see multiple Facebook charges on your credit card and they’ll all be from something like “Facebook WHNS8298DI” which is very suspicious. The Meta ads billing schedule is…unusual…to be sure. These initial charges typically range from $2 to $5, and they seem to happen back-to-back, which is why you’ll likely be hearing from your credit card company’s fraud protection department.

Facebook isn’t trying to scam you, and your card wasn’t hacked. Unfortunately, Meta decided, for some reason, to charge people in a fashion similar to scam artists. In theory, this is because they’re trying to mitigate their risk of being left holding the bag on services rendered without payment received. They’re trying to ensure your payment method works and that you’ll actually pay for the traffic they’re sending you. At the start of your ad campaign, Facebook will bill your card in small increments in rapid succession. Over time, that interval will space out and the dollar amount per transaction will increase.

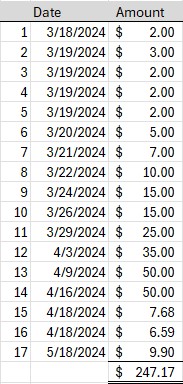

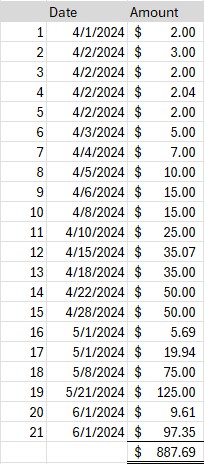

Here’s a couple real-world examples from some of our clients to illustrate the point.

Facebook’s Billing Practices for New Ad Accounts

If you’re new to running ads, the process might feel overwhelming—and these charges only add to the confusion. Facebook’s billing practices for new accounts are designed to minimize risk (for them and for you). By making smaller charges more frequently, they’re verifying that your card is valid and that payments will go through.

This system can easily trigger fraud alerts on your credit card or bank account. We’ve seen it happen to business owners just starting out with Facebook Ads, and it’s completely understandable why you’d be concerned when you see this rapid succession of charges. But rest assured: it’s completely normal for Facebook’s billing schedule.

What Can You Expect as Your Campaign Progresses?

As you continue running ads and Facebook sees a consistent history of payments, the charges will start to change. Instead of seeing multiple small charges every day or every other day, Facebook will space out the transactions and start charging larger amounts less frequently. So, after a few weeks, instead of seeing $5 here and $7 there, you might see a single $50 or $100 charge once or twice a month.

It’s Facebook’s way of saying, “Okay, we trust this payment method now.” They’ll adjust their billing practices accordingly as your ad campaign gains more traction.

Why Do These Charges Look So Suspicious?

If you’ve been scrolling through your credit card statement and see transactions labeled as “Facebook” followed by a random alpha-numeric code, you’re not alone in thinking it looks shady. Many new advertisers freak out when they see this, but it’s completely legitimate. These codes are just how Facebook categorizes and processes their transactions—nothing to worry about.

What to Do if You’re Concerned About Fraud

It’s always best to log into your Meta Ads account directly, and verify the charges from that side. DO NOT click a link in an email to get to this account because there are many phishing schemed out there that look very legitimate but are 100% just stealing your login credentials. Instead, type the address in directly. If those charges match with what you’re seeing on your card statement, you’re OK. If not, then you have to keep digging because you might have some actual fraud taking place.

In Summary

If you’re new to Facebook Ads, the way Meta handles their ad billing schedule can be a bit jarring. Seeing multiple small Facebook charges back-to-back might seem like a red flag, but this is just their way of verifying that everything’s working properly before moving on to larger, less frequent transactions.

So, don’t worry if you’ve just started advertising on Facebook and your card statement looks strange—it’s all part of their billing practices for new ad accounts. If you’re still concerned or your bank flags the transactions, just confirm that these are legitimate charges and you’ll be good to go!